Your Customers Are Deciding Without Visiting You

More than half of Google searches now end without anyone clicking a website. Add TikTok search, Amazon, Instagram Shopping and AI summaries, YouTube search and Apple App Store search, and the decision often happens before your brand ever sees a visitor. If your agency is still promising traffic growth as the primary KPI, they’re selling you a 2016 playbook.

Go Google your own company. But you must be incognito. Trench coat, hat and sunglasses optional.

Open a new tab…ideally on a stranger’s device that doesn’t know your search history. Maybe try a hotel business center or drop by an Apple Store and use a display model. Type your company name and look at what shows up. Force yourself to look at it as if you were a prospect with no loyalty and no patience.

That is exactly what I do from time to time…with clients and even with my own agency. I want to see what a skeptical prospect would see, the kind of executive who has ten tabs open, three agencies shortlisted and zero tolerance for hype. So, I type our name into Google and force myself to look at the screen as if I had never heard of us.

A few years ago, I would see our company site and a page of content, announcements, reviews, etc. But now, up comes our description, reviews, phone number, location, FAQs, a Google Business profile, “People also ask,” and an AI-generated summary that stitched together who we are and what we do in neat, confident prose. It’s clean, efficient and strangely complete. And I don’t even have to click my own website. If I don’t need to click to understand us, why would anyone else?

If you haven’t Googled your company recently, you may find it clarifying. Marketing is losing the right to be the final step. The old funnel assumption is breaking

Welcome to the world of zero-click search.

For two decades, marketers operated on a comfortable assumption: discovery leads to traffic, traffic leads to conversion and conversion happens on your website. The website was the stage. Search was the usher. Social was the invitation. Paid media was the spotlight. Now the customer often makes the decision before the website ever loads, and the shift is measurable, global and accelerating.

This shift is called zero-click search. It simply means someone types something into Google and gets their answer directly on the results page without clicking through to any website. According to SparkToro, nearly 60% of Google searches in the United States and the European Union now end without a click, and a growing share of remaining clicks go to Google-owned properties. That means most searches do not produce traffic for independent websites.

At the same time, GroupM’s 2025 forecast projects global advertising revenue to exceed $1.15 trillion, and digital advertising alone accounts for an estimated $720 billion globally in 2025 according to eMarketer projections. The industry is investing aggressively in attention even as measurable clicks decline. Money is up. Clicks are down.

Why Google is keeping the customer on Google

To understand why this is happening, you have to look at how search itself has changed — and how Google actually makes money.

Google does not earn revenue when someone clicks an organic search result. It earns revenue when someone clicks a paid ad. Alphabet’s advertising revenue is expected to exceed $255 billion globally, with search advertising remaining the dominant contributor. Google’s business is not distributing traffic to websites. It is capturing intent and monetizing it.

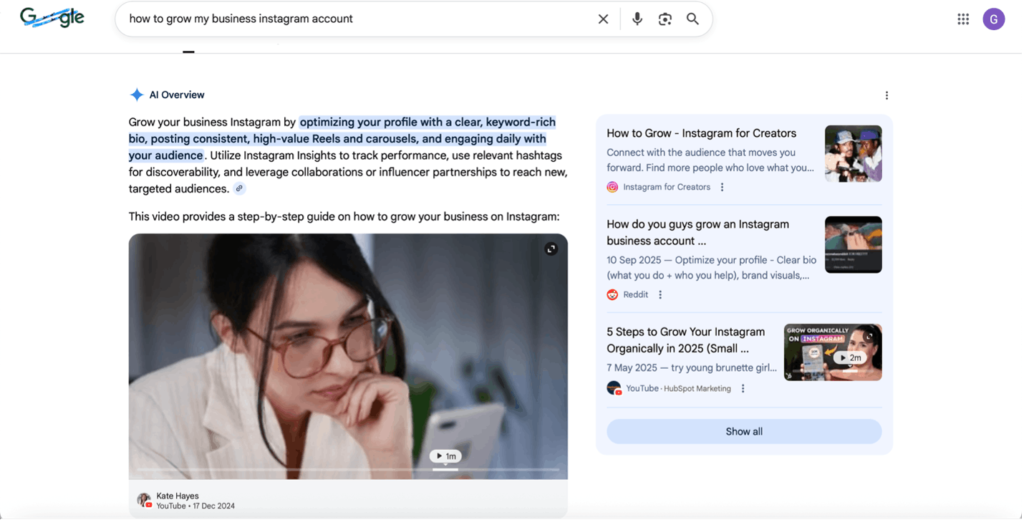

Google has introduced Featured Snippets, which display a summarized answer at the top of the page, Knowledge Panels, which show company profiles on the right-hand side and AI Overviews, which use artificial intelligence to generate a summary from multiple sources. These features keep users inside Google longer, increase engagement with the results page and protect Google from losing users to TikTok, Amazon, YouTube or ChatGPT.

An AI Overview is a Google-generated answer that combines information from different websites into a single summary displayed directly in search results.

If your insight feeds that answer but the user never visits your site, your content is consumed without traffic. From Google’s perspective, the user was satisfied, remained on the platform and is more likely to perform another search — possibly a commercial one with paid ads attached.

Most zero-click searches are informational and were never the most lucrative queries. High-intent commercial searches — “buy,” “best,” “near me” — still carry paid placements. Google can afford to answer informational queries directly because the real monetization engine is commercial intent.

Reuters and The Wall Street Journal have reported that Google’s AI Overviews are reducing referral traffic for certain publishers. At the same time, AI summaries function as a defensive strategy. If users get fast, coherent answers inside Google, they are less likely to defect to external AI tools.

When you Googled your company, did you notice how much of your story was already told before anyone clicked? If the customer forms an opinion from that summary, your website becomes optional — and from Google’s perspective, that is the system working exactly as designed.

Search is splintering: people are searching on TikTok and Instagram

Search behavior is also fragmenting across platforms. Google executives acknowledged that roughly 40% of young users turn to TikTok or Instagram for search-style queries such as restaurant recommendations. TikTok is estimated to exceed 1.6 billion monthly active users globally. YouTube reports over 2.7 billion monthly logged-in users worldwide.

Apple’s Services segment is projected to exceed $90 billion in annual revenue for fiscal 2025, reflecting the continued monetization of App Store and in-platform search.

Deloitte’s 2025 Global Gen Z and Millennial Survey found that social media influences more than half of Gen Z purchase decisions worldwide. If someone searches “best coffee in Dubai” inside TikTok, YouTube or Instagram, they watch videos, read comments and decide. Discovery, evaluation and validation all occur inside the app. No website is required and no Google Analytics session is recorded.

If your category is being searched inside TikTok, YouTube or Instagram, have you looked at what appears there under your brand name?

Amazon and retail media: the funnel collapses inside the store

Ecommerce platforms have quietly gone even further. Amazon is projected by analysts to exceed $650 billion in revenue for 2025, and accounts for roughly 40% of ecommerce sales in the United States.

On Amazon, discovery, reviews, comparison, pricing and transaction all happen inside the platform. Brands invest heavily in Amazon advertising and search optimization because consumers rarely leave the platform to visit brand websites.

Retail media — advertising inside ecommerce platforms using shopper data — is one of the fastest-growing segments of global advertising because it places marketing directly at the point of purchase. Global retail media spend is projected to surpass $170 billion, according to eMarketer estimates.

If you sell on Amazon, your Amazon listing is your brand and the click to your own website is largely irrelevant if the sale happens inside the platform. Have you searched your product inside Amazon the way a customer would?

Social commerce: inspiration and purchase now live in the same place

Meta, the parent company of Facebook and Instagram, reported over 4 billion monthly active users across its family of apps and is projected to continue modest user growth. Instagram Shopping allows users to discover and purchase products directly within the app, and Shopify reports that social commerce continues to grow rapidly for many merchants globally.

The traditional funnel separated inspiration and transaction into different steps and different places. Social platforms have fused them.

When someone discovers you on Instagram, can they buy without ever leaving? If they can, your website may not matter. If they cannot, you may be forcing a click that feels unnecessary.

AI answers compress the journey even more

Artificial intelligence is adding another layer of compression. ChatGPT reached 100 million users within two months of launch and now handles billions of prompts. OpenAI is projected to exceed 150 million weekly active users. Microsoft integrated AI into Bing and Google embedded AI Overviews directly into search.

When someone asks an AI tool, “What are the best marketing agencies in Dubai?” the answer may be a summarized list compiled from multiple sources. The user may form an opinion without ever visiting a single website.

The New York Times filed a lawsuit against OpenAI alleging unauthorized use of its content and Axel Springer signed a licensing deal with OpenAI, both reactions to a world in which consumption is shifting from page views to AI-generated answers. Have you asked an AI tool what it says about your company?

A preview of the future: super-apps

A super-app is a platform that combines messaging, payments, shopping and services in one ecosystem. In China, WeChat has over 1.3 billion monthly active users and continues to grow modestly into 2025 according to Tencent projections, and brands operate mini-programs inside WeChat where users can browse, pay and access customer service without leaving the app.

In that model, the website is optional because the platform owns the entire journey from awareness to transaction to loyalty. The Western web is not fully there yet, but the direction of travel is obvious.

What marketers should do now

So what should marketers actually do in response, beyond panicking about traffic reports?

First, stop equating traffic with relevance. If more than half of searches end without a click, declining sessions do not automatically mean declining demand. They may mean resolution happened upstream.

Second, treat search results as prime advertising real estate. Your Google Business Profile, reviews, structured data and FAQs should be curated with the same care as your homepage. Structured data is a standardized format that helps search engines understand and display information about your business.

BrightLocal’s 2025 Consumer Review Survey found that 87% of consumers read online reviews before choosing a business, and many of those reviews are visible directly in search results. If you Googled your company, what would those reviews communicate before anyone clicked?

Third, design content that survives compression. Clear definitions, credible data and concise positioning increase the likelihood that AI summaries and featured snippets represent you accurately.

Fourth, build platform-native strength. If your audience searches on TikTok, invest in TikTok search optimization. If your product sells on Amazon, master Amazon ranking and retail media. If Instagram drives discovery, design for in-app purchase journeys.

Budgets should move closer to the decision surface. That means shifting investment from driving clicks to strengthening presence where the decision is formed. More into retail media if the sale happens inside Amazon. More into review acquisition and reputation management if the choice is made on Google’s results page. More into platform-native content if discovery happens on TikTok or Instagram. More into brand clarity if AI summaries are shaping perception before interaction.

It also means reallocating some performance spend into influence infrastructure. That includes structured data, first-party data systems, creative that is built for compression and measurable brand lift studies. If clicks are no longer the reliable proxy for intent, then capital must follow influence, not sessions.

Fifth, measure influence, not just clicks. McKinsey’s 2025 consumer research confirms that more than 70% of consumers engage in omnichannel journeys, meaning they interact across multiple platforms before purchasing. Brand lift studies, share of search and platform-specific conversion metrics provide a more realistic picture of impact than raw sessions.

Finally, sharpen your positioning. When the decision happens inside a search result, a TikTok video or an AI answer, your value proposition must be unmistakable.

If you haven’t Googled your own company recently, do it. Then ask yourself a simple question: Would you click?

Sources: SparkToro Zero-Click Search Update 2025, GroupM This Year Next Year Global Advertising Forecast 2025, eMarketer Global Digital & Retail Media Forecast 2025, Alphabet 2025 Analyst Revenue Projections, Amazon 2025 Revenue Projections (Consensus Estimates), Meta 2025 Earnings Guidance, OpenAI 2025 Usage Disclosures, Tencent 2025 Projections, Deloitte Global Gen Z and Millennial Survey 2025, BrightLocal Consumer Review Survey 2025, McKinsey Global Consumer Research 2025