Why Premium Is No Longer About Quality

Quality still matters. It’s just no longer the only reason people pay more. Premium today is psychological, operational and perceptual—and many brands are still mispricing it.

We spend much of our time helping brands justify premium pricing by identifying a product lever and exploiting it with creative precision. Sometimes that lever is a genuine, superior feature or benefit we can expose and amplify. That has often been the case with brands like Samsung or Logitech, where technological or performance advantages are real and marketing’s role is to make them unmistakable.

But in many other cases—especially in FMCG—quality is already apparent and competitors, who almost always charge less, have reached functional parity. That’s where creative marketing becomes the only differentiator. For brands like Coca-Cola, Filippo Berio and TABASCO®, our goal wasn’t to prove quality. It was to create meaning, preference and justification where none existed on paper.

That’s the job. Find the thing that makes the brand worth choosing—and worth paying more for—even if we have to invent one. The assumption was sound: if you could credibly anchor a product to superiority, distinction or meaning, people would pay more.

What’s changed isn’t the role of marketing. It’s the nature of the premium itself.

Quality didn’t disappear. It became assumed

Across most categories, baseline quality is now high. In many cases, it is indistinguishable at the point of use. A search or just about anything on Amazon is proof enough.

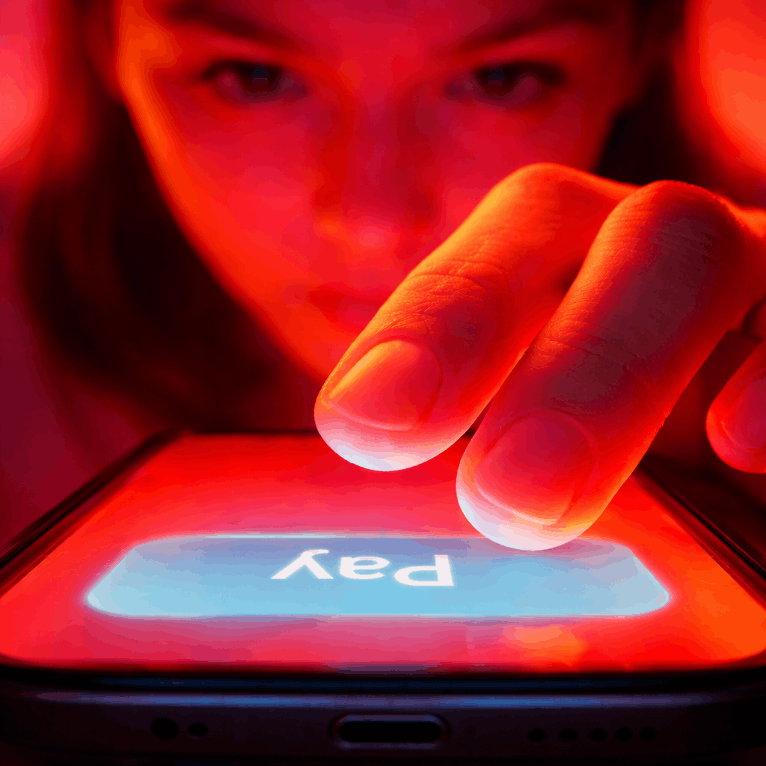

This isn’t a philosophical shift; it shows up clearly in behavior. Global cart abandonment still sits at roughly 70%, according to Baymard Institute benchmarks. People don’t abandon carts because the product suddenly became bad. They abandon because doubt creeps in at the moment of commitment. Too many options. Too many conditions. Too much effort to feel confident.

That’s why private-label products continue to gain share globally. NielsenIQ reports that private labels now account for over 22% of global FMCG value sales, with the fastest growth in Europe. Consumers aren’t rejecting quality brands. They’re rejecting the idea that quality alone justifies a premium.

When quality is assumed, the decision shifts from “is this good?” to “is this safe to choose?”

Premium has become risk reduction

Modern premium pricing buys reassurance. It reduces the chance of regret, hassle, explanation or blame.

Morgan Stanley’s research on the convenience economy shows consumers are willing to pay around 5% more simply to save time and mental effort. PwC’s Global Consumer Insights Survey shows consumers are willing to pay nearly 10% more for sustainably produced goods—not because sustainability improves performance, but because it reduces moral and reputational friction.

Starbucks illustrates this shift cleanly. Roughly 31% of U.S. transactions now run through their mobile order and pay. The premium isn’t just quality or taste of the product. It’s predictability. Skip the line. Know what happens next. Cognitive relief as value.

Costco operates on the same logic. Membership renewal rates hover around 90% in North America. That loyalty isn’t driven by aspiration or storytelling. It’s driven by trust in pricing and confidence in outcomes. Limited choice is not a compromise. It’s the premium feature.

Luxury and premium now operate on different logics

This is where many brands still get confused. Premium reduces anxiety. Luxury tests fluency.

Luxury works by signaling that not everything is explained or easily accessible. Hermès demonstrates this discipline relentlessly. Scarcity is protected, prices continue to rise and access remains uneven. In 2024, the brand delivered double-digit constant-currency growth while much of the sector struggled. That growth wasn’t driven by better products. It was driven by preserved desirability.

When that discipline breaks, the damage is fast. Gucci’s sales declined sharply in 2024 as overexposure and creative inconsistency eroded meaning, contributing to a double-digit revenue drop at Kering (the French luxury holding company that owns Gucci, Saint Laurent, Bottega Veneta, Balenciaga and several other brands). When luxury becomes too visible, it doesn’t become premium. It becomes incoherent.

Burberry’s retrenchment reinforces the point from the recovery side. After years of dilution, the brand narrowed focus back to core outerwear and pricing discipline. Analysts framed this not as a product fix, but as a necessary reset of brand meaning.

Premium grows by removing drama

As consumers become more cognitively overloaded, premium brands can often win by subtraction.

Capgemini reports that 32% of consumers now purchase via social commerce, up from 24% the year before. In that environment, no one has time to evaluate detailed quality claims. Trust signals, ease of return and brand reassurance matter more than feature lists.

Apple’s sustained pricing power reflects this reality. ACSI data continues to place Apple at the top of smartphone satisfaction scores, not because each product leapfrogs competitors, but because the ecosystem reduces learning cost, service friction and resale anxiety. The premium is confidence.

Where brands misread the moment

Luxury brands fail when they chase growth through accessibility. Broader distribution, louder campaigns and cheaper entry points may look like momentum, but they hollow out meaning. Bain–Altagamma research shows the global luxury customer base shrank by around 60 million consumers between 2022 and 2024, driven largely by price fatigue and loss of perceived value.

Premium brands fail when they borrow luxury’s opacity. Artificial scarcity, vague pricing and unnecessary complexity don’t feel elevated. They feel irritating.

Mass brands fail when they raise prices without rebuilding the experience. McKinsey reports that over 70% of consumers traded down or switched brands in 2023–2024 in response to price increases that weren’t matched by perceived value.

What this means for marketing decision-makers

The uncomfortable implication of all this is that premium pricing today is not primarily a communications problem. It’s a design problem. A decision-architecture problem. A reassurance problem.

If your premium story still relies on telling people that something is “better,” you’re likely overestimating how much cognitive bandwidth they’re willing to give you. In most categories, quality is assumed. What isn’t assumed is whether choosing you will create work, friction, second-guessing or internal consequences for the buyer.

This is why many premium strategies fail even when the product is genuinely good. Marketing adds more features, more messaging, more claims and more justification—exactly the wrong instinct in an environment where people are already overloaded. The real opportunity is usually the opposite: identifying where uncertainty enters the decision and removing it systematically.

That might mean narrowing choice rather than expanding it. It might mean simplifying pricing instead of “value engineering” it. It might mean making outcomes more predictable rather than more exciting. Or it might mean recognizing that the real premium you’re selling isn’t superiority at all, but confidence—the confidence that this choice won’t have to be defended, explained or undone later.

For luxury brands, the risk is over-communication and over-availability. Desirability doesn’t scale the way efficiency does. Once everything is explained and everywhere is accessible, the brand doesn’t feel generous. It feels diluted.

For premium brands, the danger is mistaking ambiguity for elevation. Mystery without meaning doesn’t feel premium. It feels annoying. Premium buyers aren’t looking to decode your brand. They’re looking to make a smart, low-risk decision and move on.

The marketers who get this right stop asking how to sound more premium and start asking where they can make the decision feel safer, calmer and harder to regret. Because today, people aren’t paying more to get something better. They’re paying more to stop thinking about whether they made the wrong choice.

Sources: Baymard Institute – Cart Abandonment Rates, PwC – Global Consumer Insights Survey 2024, Morgan Stanley – Convenience Economy Research, NielsenIQ – Global FMCG & Private Label Trends, Bain & Altagamma – Luxury Market Studies, Reuters – Luxury sector reporting, Starbucks Investor Disclosures, ACSI – U.S. Customer Satisfaction Index, Capgemini – Social Commerce Consumer Trends, McKinsey – Consumer Trading-Down Research