Subscription Overload: Consumers Aren’t Cancelling Brands, They’re Cancelling Complexity

The subscription model didn’t fail. It overreached. What we’re seeing now isn’t collapse but erosion, as consumers quietly rebel against pricing opacity, forced commitment and mental overload.

I don’t resent subscriptions because I dislike the content or because I don’t appreciate the business model. I resent them because at some point the whole system starts to feel like a scam.

At last count, I subscribe to Apple TV, Amazon Prime, Peacock, Paramount+, Netflix, HBO, Disney+ and Hulu. I subscribe to The New York Times, The Wall Street Journal, Gulf News and a few other publications I’m sure once felt essential. On the work side, I pay for Canva, ChatGPT, Perplexity, Adobe Creative Suite and various SaaS tools that seemed indispensable at the moment I signed up. And countless others…some I have probably forgotten entirely, quietly billing me each month like digital ransom.

Every so often I hit the same breaking point. I want to unsubscribe from everything and start over. Not because the content is bad. But because the cognitive load becomes absurd. I find myself setting calendar reminders to cancel “introductory offers” before the anniversary date hits and the price suddenly jumps three, four or five times higher than what I originally agreed to. The Wall Street Journal is a masterclass in this. The journalism is excellent. The pricing feels like a bait-and-switch. It’s hard not to feel ripped off.

What bothers me most isn’t the money. I can afford these subscriptions. What bugs me is the auto-renew culture, the annual price creep with no additional value and the assumption that customers won’t notice or won’t bother to act. Of course I don’t use all of these services every month. Nobody does. And the worst offenders are still the ones that make cancellation deliberately painful. Easy online signup, but to cancel you need to call, email or argue with a chatbot trained to misunderstand you. That should be criminal. Frankly, auto-renew on credit cards should be opt-in every year, not opt-out. If a brand had to re-earn permission annually, behavior would change overnight.

When Winning Turned into Overreach

Subscriptions won because they removed friction at the point of purchase and turned commitment into convenience. Zuora’s Subscription Economy Index (Zuora is a subscription billing and analytics software company) showed subscription businesses growing 3.4x faster than the S&P 500 over a 12-year period, proof that predictability beats persuasion when it’s done right. Netflix, Spotify and Adobe trained consumers to accept “small monthly” as painless, while enterprise SaaS (software delivered via subscription rather than one-time license) followed with multi-seat, multi-year lock-ins that CFOs tolerated because growth disguised the complexity.

The problem was never the model. It was the pile-on.

Subscription Inflation Is Mental, Not Just Financial

Today, households juggle a staggering number of subscriptions. Deloitte (a global professional services firm) reports that the average US consumer manages between 10 and 15 paid services, many of which go unused in any given month. Klarna data in Europe (Klarna is a global payments and buy-now-pay-later platform) shows consumers regularly forgetting active subscriptions entirely, only discovering them during bank or card reviews.

This isn’t a budgeting problem. It’s mental clutter. When every brand insists it’s essential, the brain quietly rebels.

The Feature Subscriptions Forgot to Build: Mercy

What most subscription businesses failed to build wasn’t better pricing. It was mercy.

Life isn’t linear. People travel. Projects end. Budgets tighten temporarily. Attention shifts. When the only way to stop billing is to cancel entirely, brands turn short-term fatigue into permanent churn. In many cases, I don’t want to leave a service. I want to stop for a month or two without feeling punished or forced to make a dramatic exit.

Pause acknowledges reality. Cancel assumes betrayal.

Streaming’s Quiet Admission of Guilt

Streaming platforms didn’t introduce ad-supported tiers because they suddenly fell back in love with advertising. Netflix’s ad tier reached more than 40 million monthly active users globally within its first year because viewers wanted optionality.

Disney+, Hulu and Amazon Prime Video followed with bundles and mixed tiers, effectively admitting that one-size monthly pricing no longer fits how people actually watch. The smartest shift wasn’t ads. It was flexibility.

SaaS Learns the Cost of Rigidity

Enterprise software is going through a similar reckoning. Usage-based pricing moved from experiment to expectation. Snowflake’s consumption model (Snowflake is a cloud data platform that charges based on usage) reframed value around usage rather than contracts, aligning cost with real demand and enabling scale without resentment.

Atlassian’s move away from perpetual licenses toward flexible cloud tiers (Atlassian is an enterprise collaboration software company) reflected a simple truth: teams change faster than procurement cycles. Gartner (a global technology research and advisory firm) now reports that more than half of SaaS vendors offer hybrid pricing models, not out of generosity, but because rigidity kills expansion.

Consumers Aren’t Anti-Subscription, They’re Pro-Control

Consumers aren’t rejecting subscriptions. They’re rejecting helplessness.

McKinsey research (McKinsey is a global management consulting firm) shows churn drops when customers can pause, downgrade or temporarily suspend services without penalty. Spotify’s family and student plans reduced churn not by lowering prices, but by matching life stages. Peloton’s troubles (Peloton is a connected fitness subscription company) weren’t just about hardware fatigue. They were a warning about stacking premium subscriptions on top of premium commitments without flexibility.

Control has become the new loyalty program.

Bundling Is Back, But It Grew Up

Bundling is returning, but smarter. Apple One (Apple’s multi-service subscription bundle) works not because it’s cheaper, but because it collapses multiple decisions into one mental category.

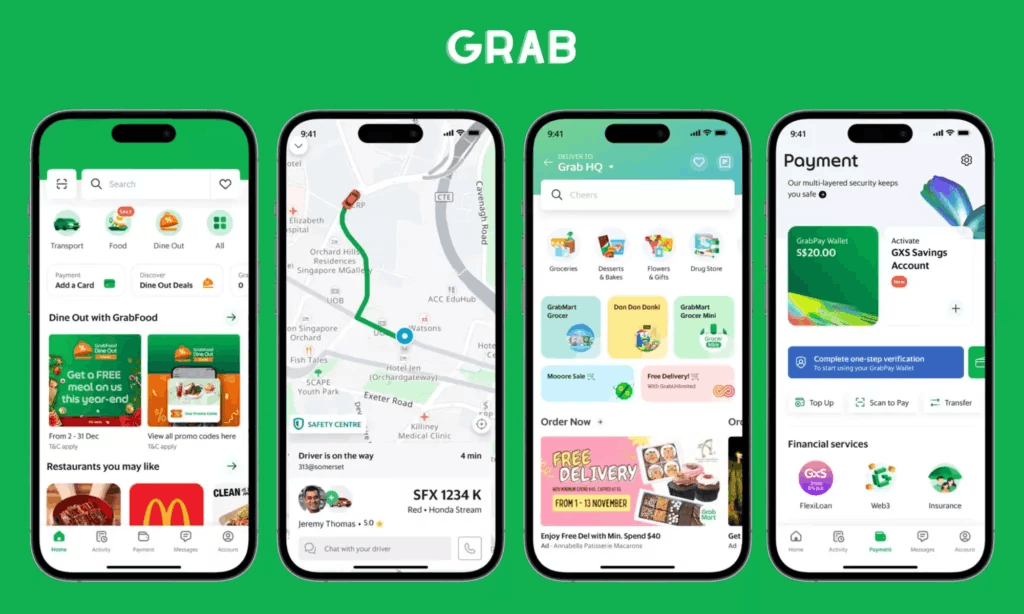

In Asia, super-apps like Grab and Gojek (ride-hailing and payments platforms that bundle multiple services) bundle transport, payments and subscriptions into ecosystems that feel simpler despite enormous underlying complexity. Simplicity is a perception problem, not a pricing one.

Paid Simplicity Is the New Premium

The next premium isn’t access. It’s clarity.

Brands like Notion (a productivity and workspace software platform) and Canva (a design platform for non-designers) don’t win on price alone. They win because their pricing ladders are legible. Bain research (Bain & Company is a global management consulting firm) shows customers are more willing to pay higher prices when pricing structures are transparent and predictable.

A visible pause option is part of that clarity. It signals confidence, not weakness.

What Unbundling Actually Means

Unbundling doesn’t mean stripping value. It means separating commitment from consumption.

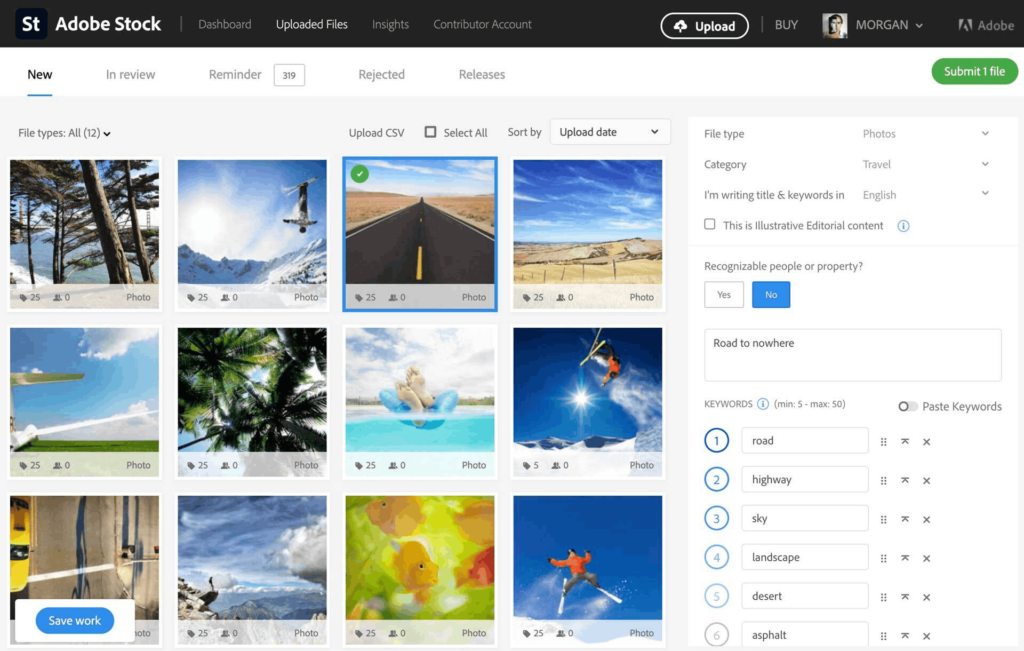

Adobe’s photography plan succeeds because it isolates a real use case instead of forcing an entire creative suite. Automotive brands experimenting with feature subscriptions learned the hard way that nickel-and-diming basics destroys trust faster than high sticker prices ever could.

Unbundling only works when it feels fair and reversible.

Designing the Exit Is Now Strategic

Zuora’s 2025 Subscription Economy Index shows subscription companies still growing 11% faster than the S&P 500. The leaders share one trait. They design exits as carefully as entries.

Pause, downgrade and resume paths are no longer edge cases. They are core product decisions. If cancelling feels respectful, returning feels natural.

What Marketers Should Do Now

If you’re a marketer and all this feels uncomfortable, good.

First, stop measuring success only by acquisition and retention. Start measuring cognitive load. How many decisions does a customer have to make just to stay with you? How many reminders do they need to set to avoid feeling tricked? If your best customers need spreadsheets or calendar alerts to manage your pricing, that’s not loyalty. That’s fatigue.

Second, design the pause as carefully as the signup. A pause option isn’t a leakage point. It’s a trust signal. Customers who pause instead of cancel are telling you they still see value, just not right now. Treat that as intent, not abandonment. Build messaging, UX and lifecycle communications around pause as a normal state, not a failure.

Third, flatten your pricing story. Not cheaper. Clearer. Most pricing pages look like legal documents written by someone terrified of leaving money on the table. The irony is that opacity kills far more lifetime value than simplicity ever will. If a customer can’t explain your pricing to someone else in one sentence, you’ve already lost.

Fourth, stop punishing honesty. Customers who downgrade or reduce usage are not disloyal. They’re being rational. Brands that reward that honesty with flexibility get invited back. Brands that weaponize friction get ghosted.

Fifth, treat renewals as a moment of respect, not a trap. Customers should receive ample, unmistakable warning before a renewal charge hits, especially when pricing has increased. Silent auto-renewals and surprise price jumps don’t drive retention. They drive resentment.

Finally, treat exit as part of the brand experience. The way someone leaves you will define how they talk about you long after they’re gone. Cancelling should be as easy as joining. Don’t hide the cancel subscription button. Highlight it. It signals confidence in your offering. If cancelling feels respectful, returning feels natural. If cancelling feels like a hostage negotiation, they won’t come back, even when they want to.

This isn’t a pricing problem. It’s a marketing problem.

The Rule for the Next Subscription Era

The subscription era didn’t die. It matured.

The brands that win next will stop asking how to lock customers in and start asking how to stay useful without demanding constant attention. Consumers aren’t cancelling brands. They’re cancelling the noise around them.

Sources: Zuora Subscription Economy Index (2024, 2025), McKinsey Global Consumer Sentiment Reports, Deloitte Digital Media Trends, Gartner SaaS Pricing Forecasts, Bain & Company Pricing and Loyalty Studies, Netflix Investor Updates, Apple Services Financial Disclosures, Snowflake Investor Materials, Klarna Consumer Spending Reports, Statista Global Subscription Data